There are many people who feel filing a sales tax return is extremely easy and less complicated. Well, this post is a knock-knock to all those who feel sales tax is fun. But in reality, it is not. In fact, it is a lot of work compared to any other administrative chores if you are in the business. Also, when you are in the industry doing business irrespective of the size, you are ought to keep a tab on sales tax returns by a sales tax calculator to lead a hassle-free business. Otherwise, you can face a lot of legal issues leading to penalties and in fact, at times, you can be behind the bars as well. If you are not pretty confident about your expertise in filing sales tax returns, it is better to use a professional firm having expertise in Business Advice Hobart.

Are you a newbie in the industry? If yes, then this blog-post will come in handy for you as we are listing a number of important things that you should know about sales tax that will help you conduct your business properly.

Table of Contents

A Guide to All Important Things to Know About Sales Tax

Sales tax is controlled and governed by the State

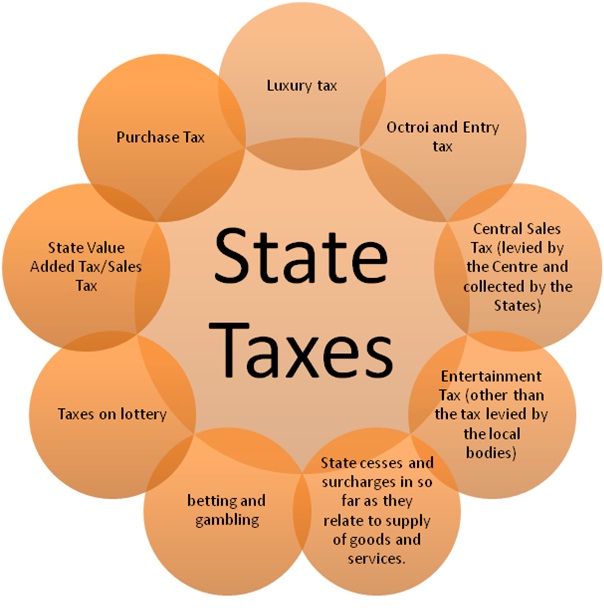

There is nothing called one national sales tax which means sales tax is different for each every state. That said, if one state is charging ‘X’ sales tax, then another state will charge ‘Y’ sales tax. That’s why when people come into the business, they should be aware of their state rules. Also, a state formulates laws and policies regarding sales tax so one should be aware. In addition, also note that sales tax is collected to pay for schools, roads and public safety.

Sales tax rates always varies

Sales tax rates vary from state to state and cities to cities. This becomes important for one to know especially when they are operating from different states and cities. For instance, one city may charge 6.5% sales tax while other city may charge 8.5% sales tax. This means you should know the rates properly before starting off your business or else you will be in a pool of confusion due to this variation.

Tangible personal property is taxable but with exceptions

Did you know states are allowed to make their own rules when it comes to dissecting the items that are taxable? In general, tangible personal properties are taxable but there are exceptions. For instance, some states charge tax for groceries while some for textbooks. Also, note that services are not taxable so if anyone wants tax for their service, you should know your rights.

Sales tax is collected by the state only where there is Nexus

You don’t need to pay sales tax until and unless you have a nexus in the state. For example, an online seller usually can cater to all their customers all over the USA. But they are required to pay taxes only where they have their nexus. Here are a few factors that create nexus and they are:

- When you run your business from the state.

- When you have a location of your office, store or warehouse.

- When you have employees and other independent professionals.

- When you have to export or import your products.

- When you have an intermediary body who does transactions for you

- When you conduct temporary business like fairs and craft shows.

To collect sales tax, register with the State before

Just because you have a nexus in the state doesn’t mean you can pay sales tax. Instead, you have to get a sales tax permit before getting a sales tax calculator by registering with the state, and only after then you can collect sales tax. In addition, if you do it without a permit, you can fall prey to fraudulent acts that can lead to chaos in the business.

When Are You Registering for Sales Tax Permit?

As you know that you can’t collect sales tax without getting a permit, so, you have to get the legal formalities done before you begin conducting your business. By doing so, you will not only be relieved but also know what to do and when to do if there is a problem in the near future. For more information, you can always reach out to the tax professionals.